So, you’ve decided to start budgeting -awesome! But where exactly do you begin?

You start by paying attention.

Before you can tell your money where to go, you need to understand where it’s already going. That’s why tracking your income and spending is the very first step.

And no – you don’t need to download 10 apps, memorize budgeting formulas, or create a perfect color-coded system.

You just need to start tracking. Simply. Honestly. Consistently.

It is often recommended to track your spending for at least 3 months and then start using that information to start budgeting. I personally am way too impatient so I rather look at the PAST 3 months and list all my income and expenses so I can start the budgeting process right away.

Why 3 months? One month might be fluke. Three months shows patterns – like how much you actually spend on food or subscriptions you forgot about.

Use What Works for You

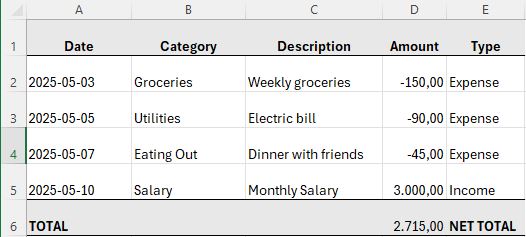

My comfort tool is Excel. I’ve been working in the accounting profession for about 20 years now so I’m very comfortable to work with Excel and I use it for almost anything. I really like the flexibility it offers – it lets me customize categories, calculate totals, and spot trends. But that’s just my way.

Your comfort tool might be just plain pencil and paper, just start with whatever feels the most comfortable to you right now. The best tool is the one you’ll actually use.

Keep it Simple

When you’re just getting started, don’t overwhelm yourself by trying to track 20+ categories. Focus on the big picture. Keep the categories few and simple – later on you can add to them, but start small so it won’t be overwhelming.

I recommend starting with these expense categories:

- Rent / Mortage

- Groceries

- Utilities

- Transportation

- Subscriptions

- Eating Out

- Miscellaneous / Other

And these income catgeories:

- Salary / Wages

- Side Hustles

- Other (e.g. tax refunds, gifts)

That’s it. Simple, clean and manageable.

It doesn’t need to be fancy, later on we can style it and make it more useful – but the purpose right now is just to list your expenses and income:

What to Look For As You Track

Once you’ve logged at least a month (or three), pay attention to:

- Categories where you’re overspending

- Expenses that repeat every month (subscriptions, rent, etc.)

- Irregular but predictable cost (like annual insurance or holidays)

- How your actual spending compares to your expected spending.

(in excel you can filter to a specific category and use the formula SUBTOTAL() to calculate only the items that are filtered!)

You’re not judging yourself here – you’re just observing. This is data you can use to make better decisions later.

Tracking is the Foundation

It might feel tedious at first, but tracking is where the change begins. It builds awareness. And awareness creates control.

First we track, then we plan. Then we win!